The cryptocurrency market is navigating a wave of pessimism as Bitcoin struggles to maintain its position above the pivotal $100,000 mark. This downturn has triggered a cascade of fear-driven selling, but a deeper look into blockchain data suggests the sell-off may be more about emotion than a breakdown in Bitcoin’s fundamental health.

The Psychology of a Sell-Off

Market sentiment has undergone a dramatic shift. Just days after flirting with new highs above $107,000, the mood has soured. The Crypto Fear & Greed Index has nosedived into “Extreme Fear” territory, sitting at a sobering 21. The once-dominant bullish chatter on social media, filled with predictions of $150,000 targets, has been replaced by uncertainty and caution.

This shift is reflected in broader market interest. Google search trends for “Bitcoin” have cooled from their October peaks, indicating a pause in retail investor enthusiasm. The altcoin market has felt this chill even more acutely, with sentiment indicators plunging to deeply negative levels.

Such rapid emotional swings are characteristic of the crypto markets. With high leverage and strong speculative participation, prices can be disproportionately influenced by crowd psychology. The current correction appears to be a classic example of a sentiment shock, where the narrative, rather than the network’s underlying data, is driving the price action.

A Look Beneath the Surface: On-Chain Resilience

While the price chart looks concerning, blockchain analytics tell a more reassuring story. Data from firms like CryptoQuant reveals no signs of structural damage to the Bitcoin network.

Crucial metrics indicate that long-term conviction remains intact. Notably, exchange withdrawals have accelerated, meaning investors are moving their BTC off trading platforms and into private wallets for safekeeping. This is typically a sign of accumulation, not panic selling. Additionally, the percentage of UTXOs (unspent transaction outputs) currently in loss has risen to around 12%—a level that signals discomfort but is nowhere near the extreme values seen during major capitulation events like the end of previous bear markets.

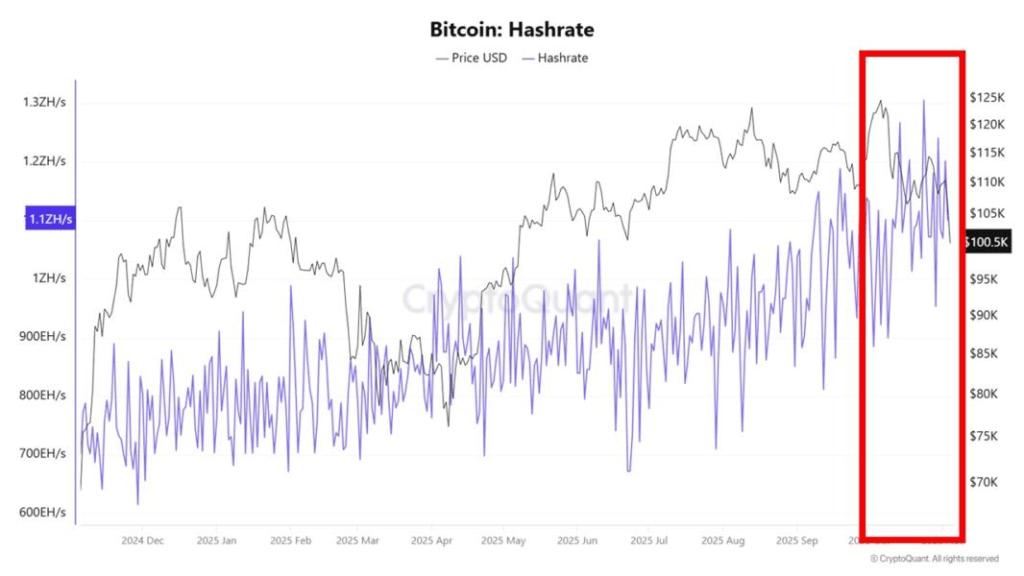

The network’s backbone also remains robust. Bitcoin’s hashrate continues to hover near its all-time high, reflecting strong miner commitment and unparalleled network security. Furthermore, a declining whale ratio suggests that large holders are not leading the sell-off, reducing the risk of a sustained, high-volume downturn.

Perhaps the most bullish signal lies in the market’s liquidity. Over $10.7 billion in stablecoins has recently moved into major exchanges like Binance. This represents a massive pool of dormant buying power waiting on the sidelines, ready to be deployed when investors believe the bottom is in.

Technical Outlook: A Battle at a Key Level

From a technical perspective, Bitcoin’s short-term trend has undoubtedly weakened. The failure to hold the $110,000 zone led to a breakdown, establishing a pattern of lower highs and lower lows on the 4-hour chart. The asset is currently trading below its key moving averages, confirming that bears have the upper hand in the immediate term.

However, all is not lost for the bulls. The dip below $100,000 was met with a sharp rebound, creating a long wick on the price candle—a clear sign that buyers aggressively defended that psychological level. This has established a critical support zone between $100,000 and $102,000.

The path forward hinges on this battle. A decisive break below this support could open the door for a further decline toward the $95,000-$98,000 range. Conversely, if buyers can muster the strength to push the price back above the $105,000-$107,000 resistance band, it would signal that the short-term downtrend has been invalidated and a relief rally is likely underway.

The Bottom Line

The current volatility is a stress test for investor conviction. While the price action and sentiment indicators are flashing red, the on-chain data paints a picture of a healthy network undergoing a routine, sentiment-driven correction. For strategic investors, these periods of fear can often present opportunities, as the underlying strength of the Bitcoin network remains unshaken.

Leave a comment