Published: November 7, 2025

Major Capital Raise Exceeds Initial Targets

Strategy (Nasdaq: MSTR) has successfully completed a significant capital raise through its new preferred stock offering, generating approximately $715 million (€620 million) in gross proceeds. The issuance, which more than doubled its initial target, demonstrates continued investor confidence in the company’s bitcoin-focused strategy.

Details of the STRE Offering

The company priced its 10% Series A Perpetual Stream Preferred Stock (ticker: STRE) at €80 per share, issuing 7.75 million shares—more than double the 3.5 million shares initially filed on November 3rd.

Key Features of STRE:

- Stated Value: €100 per share

- Dividend Rate: 10% annual yield, paid quarterly in cash

- First Payment: December 31, 2025

- Maximum Rate: Up to 18% if dividends are deferred

- Ranking: Among the highest-yielding instruments in Strategy’s preferred stock lineup

This structure provides Strategy with operational flexibility during challenging market conditions while compensating investors for accepting potential dividend deferral risk.

Use of Proceeds

According to the company’s Friday announcement, the funds will be allocated to:

- Bitcoin acquisition

- Working capital

- General corporate purposes

This follows Strategy’s established pattern of using various financing mechanisms to accumulate Bitcoin without diluting common shareholders.

Expanding Capital Framework

The STRE offering is the latest addition to Strategy’s sophisticated capital structure designed to fund ongoing Bitcoin purchases.

Previous Offerings:

STRC Series (July 2025): The first “Treasury Preferred” series raised $4.2 billion specifically for Bitcoin purchases.

Earlier Issues: STRF, STRK, and STRD were introduced before Strategy’s initial public offering, creating a layered financing approach that protects common shareholders from dilution while enabling continued Bitcoin accumulation.

Bitcoin Holdings and Recent Performance

Current Position

As of the third quarter, Strategy holds:

- Total Bitcoin: 640,808 BTC

- Percentage of Supply: Approximately 3.1% of all Bitcoin in circulation

Slowing Accumulation Pace

The company’s third-quarter results revealed a significant slowdown in Bitcoin purchases:

- Q3 2025: 1,417 BTC added

- Q2 2025: Over 9,000 BTC added

- Q1 2025: Approximately 12,000 BTC added

Market Metrics

The company’s mNAV (modified Net Asset Value) multiple—a critical measure of its market premium—has compressed to roughly 1.2×, marking the lowest level since early 2023.

Market Analysis and Outlook

Analyst Perspective

Industry analysts characterize the accumulation slowdown as cyclical rather than structural. Key observations include:

- Strategy remains on track to achieve its 30% bitcoin-yield target for 2025

- Accumulation could accelerate once market conditions and funding premiums improve

- The company’s strategy remains fundamentally intact

Current Market Conditions

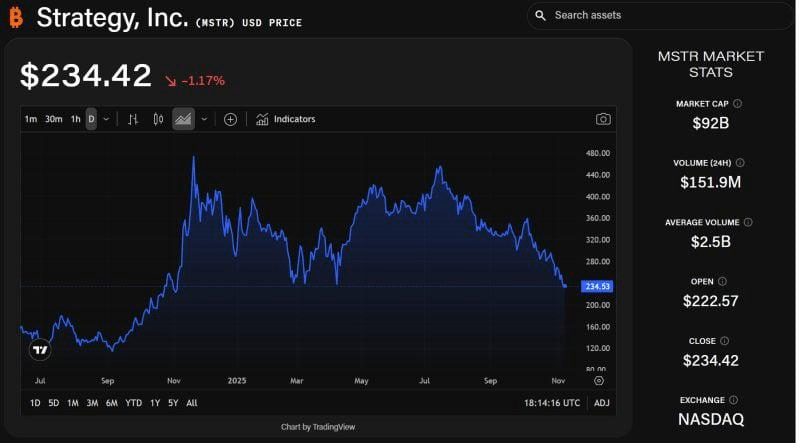

Bitcoin is currently trading above $100,000, though the market has experienced volatility amid ongoing macroeconomic pressures. Strategy’s MSTR common stock was trading just under $235 on Friday, approaching year-to-date lows.

Investment Strategy Context

The success of this offering—particularly its significant oversubscription—indicates that institutional and retail investors continue to view Strategy’s preferred stock as an attractive way to gain high-yield exposure to Bitcoin without directly holding the cryptocurrency.

The perpetual preferred structure offers investors:

- Regular, predictable income through quarterly dividends

- Indirect Bitcoin exposure through a publicly-traded vehicle

- Senior claims to company assets compared to common shareholders

Looking Ahead

With this latest raise, Strategy continues building its war chest for Bitcoin accumulation. The company’s multi-layered capital structure allows it to take advantage of favorable market conditions while maintaining financial flexibility during periods of volatility.

As Bitcoin markets stabilize and funding conditions potentially improve in 2026, Strategy appears positioned to resume more aggressive accumulation while maintaining its commitment to shareholder-friendly capital allocation.

Disclaimer: This article is provided for informational purposes only and does not constitute investment, financial, legal, or tax advice. Cryptocurrency and equity investments carry significant risks. Readers should conduct their own research and consult with qualified financial advisors before making investment decisions.

Leave a comment