Published: November 14, 2025

Market Developments

Recent turbulence in cryptocurrency markets has placed significant pressure on Strategy (MSTR), with shares declining to $197 during pre-market trading—the lowest level observed since October 2024. This downturn coincides with Bitcoin’s retreat to price levels not seen since May 2025.

Key Highlights

- Major Bitcoin wallet restructuring totaling $5.77 billion raises questions

- Company’s Net Asset Value multiple drops below unity for the first time

- Industry analysts maintain that forced liquidation scenarios remain improbable

The $5.7 Billion Wallet Movement

Market participants experienced heightened anxiety following Strategy’s transfer of 58,915 BTC (valued at approximately $5.77 billion) to new wallet addresses. The transaction immediately sparked speculation across social media platforms, with automated trading systems responding to the movement.

Expert Assessment

Industry analysts were quick to provide context, suggesting the transfer represents a custodial reorganization rather than preparation for asset liquidation. Market observers noted that algorithmic trading systems and automated bots reacted to the transaction, potentially amplifying market volatility.

“The market response appears driven more by automated systems than fundamental analysis,” one analyst noted, adding that even unverified information can create disproportionate pressure on retail investors.

Despite these clarifications, market sentiment remained cautious as participants evaluated whether underlying structural concerns might be emerging.

Historic Valuation Shift

NAV Multiple Falls Below Parity

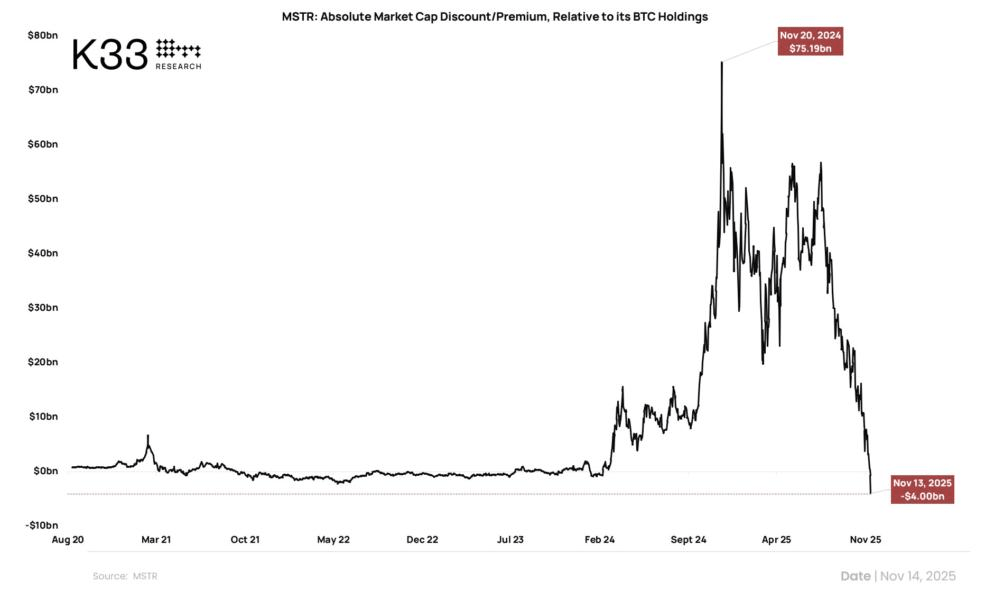

A more significant development involves Strategy’s Net Asset Value metric, which has dropped below 1.0 for the first time in the company’s history. This means MSTR shares are currently trading at a discount to the underlying Bitcoin holdings the company maintains. Current readings show the metric has recovered slightly to 1.09, though this remains historically low.

What This Means

A NAV below unity indicates investors are valuing the company at less than its Bitcoin holdings minus outstanding obligations. This valuation discount typically reflects concerns about:

- Debt management and servicing capabilities

- Liquidity positions

- Long-term viability of aggressive acquisition strategies

Equity Premium Erosion

Research from K33 highlights a substantial $79.2 billion decline in Strategy’s equity premium since November 2024. Despite raising $31.1 billion through share dilution, approximately $48.1 billion in expected Bitcoin demand failed to materialize into actual cryptocurrency purchases.

This gap suggests that investor interest in MSTR shares no longer translates directly into Bitcoin market exposure as efficiently as in previous periods.

Liquidation Risk Assessment

Expert Perspective

Bitcoin analyst Willy Woo has provided reassurance regarding liquidation concerns. According to Woo’s analysis, Strategy faces minimal risk of forced Bitcoin sales during the current market cycle, provided MSTR maintains trading levels above $183.19 through 2027—a threshold corresponding to Bitcoin prices around $91,500 with a 1x NAV multiple.

Woo’s analysis suggests the primary risk scenario would involve only partial liquidation, and only if Bitcoin significantly underperforms during the projected 2028 bull market phase.

Market Context

The current situation reflects broader cryptocurrency market dynamics, with multiple factors contributing to price pressure across digital assets. Strategy’s position as a major Bitcoin holder makes it particularly sensitive to both cryptocurrency price movements and broader market sentiment shifts.

Investor Considerations

The combination of declining NAV multiples and major wallet movements highlights the complex relationship between corporate Bitcoin holdings and equity valuations. Investors should consider:

- The distinction between custodial movements and actual asset sales

- How NAV metrics reflect market confidence in corporate strategies

- The impact of debt structures on long-term sustainability

Risk Disclosure: This content is provided for informational purposes only and does not constitute investment advice or recommendations. Cryptocurrency and equity investments carry substantial risk. All investment decisions should be based on thorough personal research and consideration of individual financial circumstances.

Leave a comment