Cryptocurrency markets showed signs of recovery this week after four consecutive weeks of decline, with Bitcoin reclaiming the $90,000 level on Wednesday. Despite recent volatility, ARK Invest CEO Cathie Wood reaffirmed the firm’s bullish $1.5 million Bitcoin price target for 2030.

Market Recovery Gains Momentum

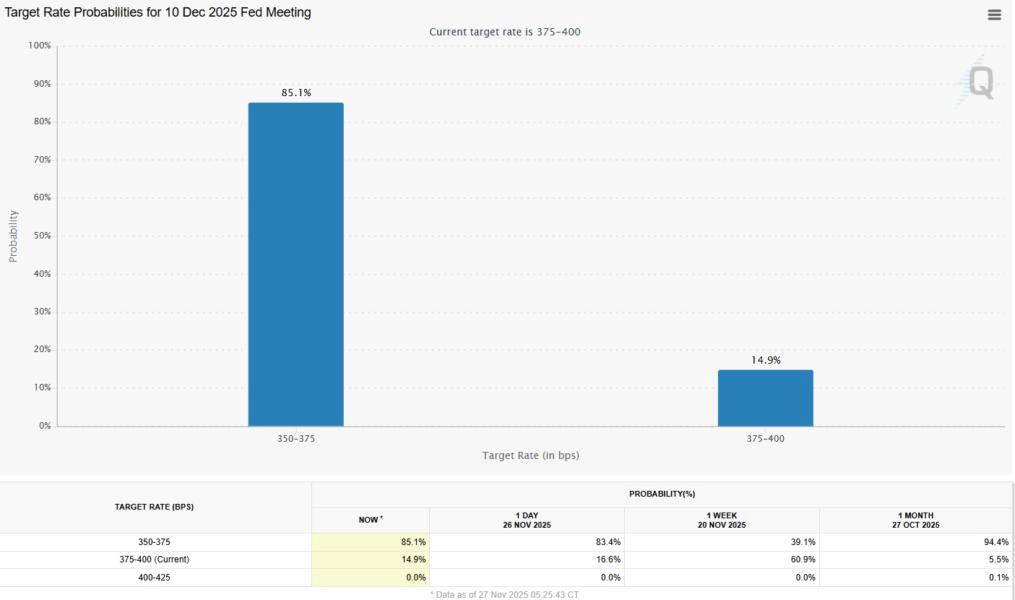

Bitcoin’s return above $90,000 brought relief to ETF holders, as the price climbed back above the $89,600 flow-weighted cost basis for ETF buyers. The recovery coincided with shifting expectations around Federal Reserve policy, as markets now price in an 85% probability of a 25 basis point rate cut at the December 10 meeting—up dramatically from 39% just one week earlier.

However, November remains challenging for Bitcoin, with the cryptocurrency down approximately 17% for the month. This marks the worst November performance in seven years, particularly notable given that November historically averages 41% returns for Bitcoin.

Liquidity Returns to Markets

ARK Invest attributes improving conditions to returning liquidity following the end of the recent US government shutdown. According to the investment firm, $70 billion has already flowed back into markets, with an additional $300 billion expected over the next five to six weeks as the Treasury General Account normalizes.

A significant policy shift looms on December 1, when the Federal Reserve is scheduled to end its quantitative tightening program and pivot toward quantitative easing. This transition involves bond purchases designed to lower borrowing costs and stimulate economic activity.

“With liquidity returning, quantitative tightening ending December 1st, and monetary policy turning supportive, we believe conditions are building for markets to potentially reverse recent drawdowns,” ARK stated in a recent post.

Bull Case Remains Intact

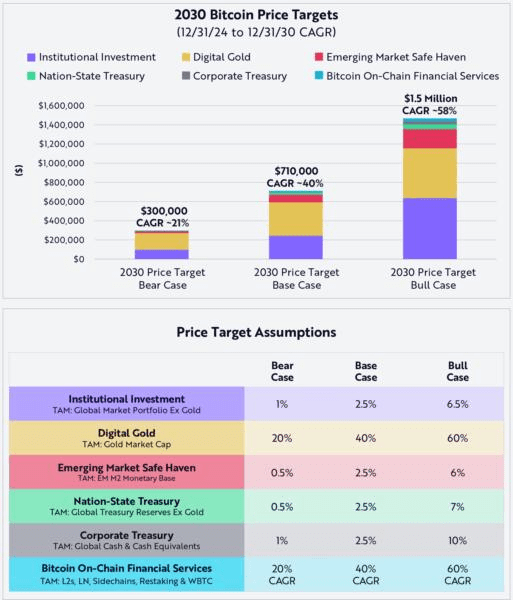

Wood emphasized that the current liquidity squeeze affecting cryptocurrency and artificial intelligence markets should reverse within weeks. Despite market corrections and the growing role of stablecoins, ARK’s 2030 price targets remain unchanged: $1.5 million in the bull case and $300,000 in the bear case.

During a Monday webinar, Wood explained the reasoning: “The stablecoins have accelerated, taking some of the role away from Bitcoin that we expected, but the gold price appreciation has been far greater than we expected. So net, our bull price, which most people focus on, really hasn’t changed.”

UK Proposes DeFi Tax Reform

In regulatory developments, the UK’s HM Revenue and Customs proposed a new tax framework that could ease burdens on DeFi users. The “no gain, no loss” approach would defer capital gains taxes on crypto lending and liquidity pool activities until underlying tokens are sold.

Current UK rules can trigger capital gains taxes of 18% to 32% whenever funds are deposited into protocols. The proposed changes would calculate taxable events only when liquidity tokens are redeemed, based on the difference between tokens contributed and received.

Industry figures welcomed the proposal. Sian Morton of Relay protocol called it “a meaningful step forward for UK DeFi users who borrow stablecoins against their crypto collateral,” while Aave lawyer Maria Riivari noted it “would bring clarity that DeFi transactions do not trigger tax until you truly sell your tokens.”

DWF Labs Launches $75M DeFi Fund

Crypto market maker DWF Labs announced a $75 million investment fund targeting DeFi projects positioned for institutional adoption. The initiative will focus on blockchain projects building dark-pool perpetual DEXs, decentralized money markets, and fixed-income products across Ethereum, BNB Smart Chain, Solana, and Base.

Managing partner Andrei Grachev emphasized the fund’s focus on practical infrastructure: “DeFi is entering its institutional phase. We’re seeing real demand for infrastructure that can handle size, protect order flow, and generate sustainable yield.”

Beyond capital, DWF Labs will provide liquidity provisioning, go-to-market strategy support, and access to exchanges, market makers, and institutional partners.

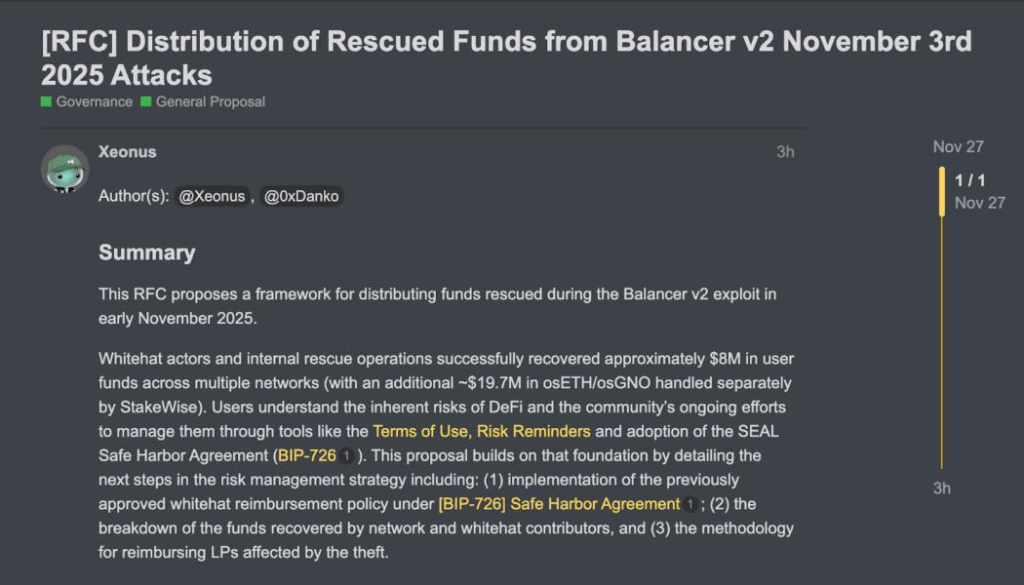

Balancer Proposes Recovery Fund Distribution

The Balancer protocol community submitted a proposal for distributing approximately $8 million recovered from a $116 million November exploit. The plan calls for non-socialized reimbursements, meaning funds would return only to affected liquidity pools on a pro-rata basis.

Victims would receive payments in the same tokens they lost to avoid price mismatches. An additional $20 million recovered by StakeWise will be distributed separately to its users.

Nasdaq Firm Makes Unusual Crypto Pivot

Enlivex Therapeutics, a Nasdaq-listed biotech company, announced plans to raise $212 million to invest in RAIN, the utility token of a decentralized prediction market on Arbitrum. The offering involves selling 212 million shares at $1 each, an 11.5% discount to recent closing prices.

Executive chairman Shai Novik explained the rationale: “We see prediction markets as one of the most exciting emerging sectors in the blockchain space, with exceptional long-term growth potential. By entering now, we benefit from a first-mover advantage in a fundamentally strong category.”

Week in Review

Among the top 100 cryptocurrencies by market cap, most ended the week in positive territory. Memecoin SPX6900 led gains with a 43% increase, followed by Kaspa’s token at 39% weekly growth.

As markets digest improving liquidity conditions and evolving monetary policy, the stage appears set for potential year-end momentum in digital assets.

This article is for informational purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile and speculative. Always conduct thorough research and consult qualified financial advisors before making investment decisions.

Leave a comment