Spot Bitcoin exchange-traded funds have reversed their recent trend of capital flight, recording approximately $70 million in net inflows during the latest trading week. This marks the first positive week following a month-long period that saw roughly $4.35 billion exit these investment vehicles.

Breaking the Outflow Trend

The turnaround arrives after an especially difficult November for Bitcoin ETFs. The most severe withdrawals occurred during the weeks concluding on November 7 and November 21, when each period witnessed $1.22 billion in departures.

Friday’s trading session brought $71 million in net inflows, elevating the sector’s total accumulated inflows to nearly $57.7 billion since these products first launched. The combined net assets across all spot Bitcoin ETFs have climbed to approximately $119.4 billion, representing about 6.5% of Bitcoin’s overall market capitalization.

Friday’s Trading Activity

The day’s flows showed significant movement across major funds:

- BlackRock’s IBIT experienced $113.7 million in outflows

- Fidelity’s FBTC attracted $77.5 million in new investments

- ARK 21Shares’ ARKB drew $88 million in inflows

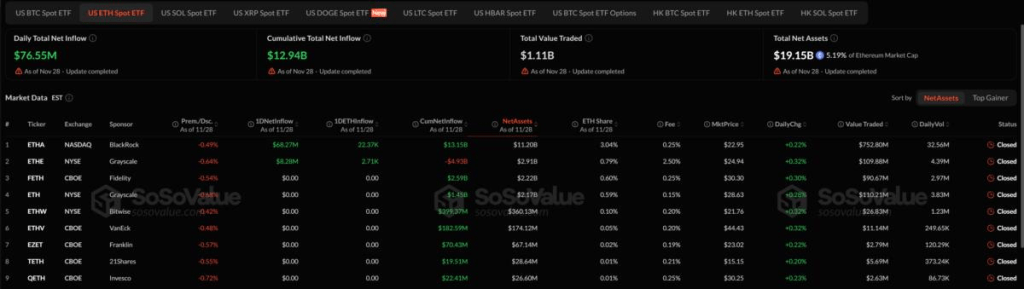

Ethereum ETFs Mirror Recovery Pattern

Spot Ethereum ETFs demonstrated a similar recovery trajectory, pulling in $312.6 million over the week after enduring three consecutive weeks of withdrawals totaling approximately $1.74 billion. The most challenging period came during the week ending November 14, which saw $728.6 million in redemptions.

Friday alone brought $76.6 million into Ethereum ETFs, pushing their cumulative net inflows to $12.94 billion since inception. Total assets under management for US spot Ethereum ETFs currently stand at roughly $19.15 billion, equal to about 5.2% of Ethereum’s market capitalization.

Market Outlook

Several market analysts are pointing to potential bullish signals for Bitcoin’s near-term price action. Technical indicators suggest the cryptocurrency may have established a short-term price floor, with the Relative Strength Index approaching oversold territory. Large-scale investors have reportedly begun reopening long positions, which some traders interpret as positioning for a potential rally toward the $100,000–$110,000 range.

Research perspectives from Bitwise Europe indicate that Bitcoin’s current valuation may not fully account for improving macroeconomic conditions, suggesting room for further appreciation.

Leave a comment