December 24, 2025

As 2025 draws to a close, Bitcoin traders face a critical moment with over $30 billion in options contracts set to expire. The market positioning suggests bearish sentiment may prevail unless Bitcoin can break through key resistance levels.

Massive Options Expiry Looms

Approximately $30.3 billion in Bitcoin options contracts will reach expiration at the end of this week, with settlement prices determined on Friday at 8:00 AM UTC. The outcome will significantly impact market sentiment after Bitcoin has spent five weeks consolidating around the $89,000 level.

The bulk of trading activity occurs on Deribit, which accounts for roughly 80% of total open interest, while the Chicago Mercantile Exchange holds about 11% of positions.

Bulls Caught Off Guard

Many bullish traders appear to have misjudged Bitcoin’s trajectory after the cryptocurrency failed to maintain support above $100,000 in November. The data reveals that most call options—totaling $21.7 billion—are positioned well above current market prices and will likely expire without value.

On Deribit specifically, fewer than 6% of call options are set at strike prices of $92,000 or below. A substantial portion of bullish bets are concentrated between $100,000 and $125,000, with some extremely optimistic positions placed as high as $150,000 to $200,000. These elevated strikes often reflect sophisticated trading strategies designed to capture volatility premiums rather than genuine price expectations.

Bears Face Risk Above $88,000

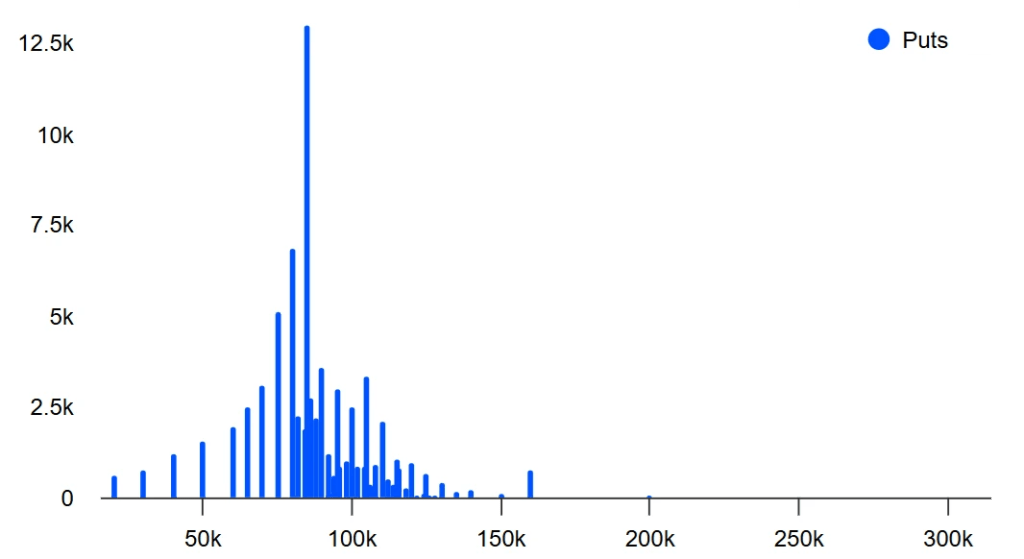

While bulls may be disappointed, bears aren’t necessarily sitting pretty either. Much of the bearish positioning through put options is clustered between $75,000 and $86,000. Should Bitcoin trade above $88,000 at Friday’s settlement, more than half of the $7.7 billion in put options on Deribit would expire worthless.

Nevertheless, bearish strategies maintain an edge as long as Bitcoin remains below the crucial $94,000 threshold.

Broader Market Concerns

Growing caution in the technology sector is contributing to market uncertainty. Corporate debt costs have risen significantly, with some major tech companies seeing protection costs reach new highs. These broader market dynamics are influencing cryptocurrency sentiment.

However, some positive catalysts remain on the horizon. Potential economic stimulus measures have been discussed by US officials, including proposed tax rebates for 2026. Additionally, expectations around future Federal Reserve policy continue to influence trader positioning.

Recent Trading Activity

Despite repeated failures to reclaim the $94,000 level over the past five weeks, optimism hasn’t completely evaporated. Recent trading data shows investors have been adding call option positions in the $90,000 to $120,000 range throughout the past week.

Key Price Scenarios

The settlement price on Friday will determine winners and losers. Here’s how different price levels would impact the net outcome on Deribit:

$86,000 – $90,000: Put options would dominate with a $2.4 billion advantage

$90,001 – $94,000: Put options maintain a $1.5 billion edge

$94,001 – $96,000: Put options hold a narrower $650 million advantage

$96,001 – $98,000: Roughly balanced outcome between calls and puts

The $94,000 Inflection Point

The analysis makes clear that $94,000 represents the critical dividing line for market direction. A settlement below $90,000 would represent a significant setback for bulls, while any price below $94,000 keeps odds tilted toward bearish positions.

Traders and investors should closely monitor price action leading into Friday’s settlement, as the outcome will likely influence positioning and sentiment heading into 2026.

This article is for informational purposes only and should not be considered financial, investment, or trading advice. Cryptocurrency markets are highly volatile and involve substantial risk. Always conduct your own research and consult with qualified financial advisors before making investment decisions.

Leave a comment